Hoang Huy gained 500 billion of profit in 2016 with no capital increase in 2 coming years

(Updated: 27/4/2017)

In the financial year of 2016 - 2017, Hoang Huy Finance reached a revenue of 1,436 billion dong, with the profit of 500 billion dong. Estimated cash dividend reached 8 - 10%.

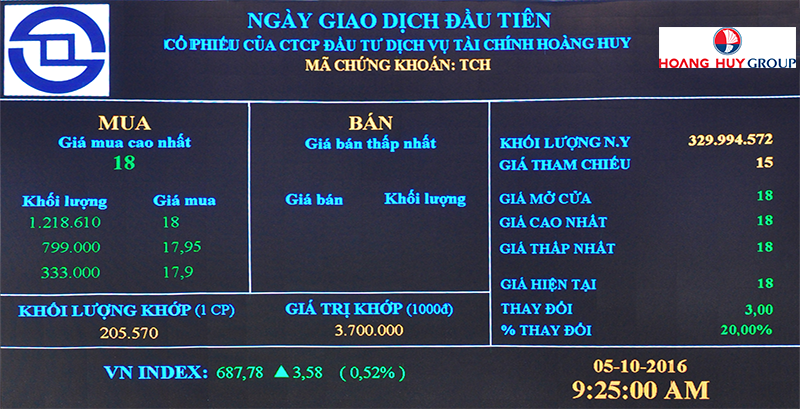

This afternoon (the 26th of April), Hoang Huy Investment Services (Code: TCH) held the Meeting - Dialogue with Investors.

At the meeting, Mr. Nguyen Huy Duong, Financial Director of TCH, said that the year 2016 - 2017 (from 1/4/2016 to 31/3/2017), revenue of the company reached 1,436 billion, in which tractor business accounted for 85%, and real estate business accounted for 10.3%.

Annual profit reached 500 billion VND, of which the vehicle business contributed 66% and about 28% of the profit came from real estate.

TCH was planning to pay dividends in cash in 2016, from 8-10%. Mr. Do Huu Hau - Deputy General Director warranted that in the next 2 years shares will not be issued to shareholders to increase capital, if such increase is necessary then capital will be mobilized from the bond or strategic partner.

In the next five years, TCH expects revenue and profit growth rate will reach 15% / year, aiming to reach 1 trillion VND of profit. TCH also plans to distribute around 5,000 American International tractors per year. The number of apartments sold in the next five years is estimated at 10,000 units, mostly affordable apartment.

Answering the questions of real estate investors, Mr. Do Huu Hau said that now the Company is focusing on developing affordable housing in Hai Phong, typically Pruksa Town.

The Pruksa Town project has been completed and will begin to be handed over from 2016. In the first four months of 2017, TCH sold 192 units, equivalent to total sales of 2016.

Currently, the average price for an affordable apartment of TCH is about 500 million VND.

Explaining the reasons for choosing the affordable segment, TCH representative said that the demand of Vietnamese people in this segment is about 70% and people always need houses. High-end housing demand is limited but oversupplied.

In the near future, TCH will focus on real estate development in Hai Phong as the demand and location thereof are favorable compared to Ho Chi Minh City and Hanoi where it’s difficult to find a cheap land with high quality. In the long term, TCH will have its own plan to expand its investment to other provinces and other segments depending on the operating situation.

In tractor business, TCH said the market share of American tractor sales was about 50%.

Products in the tractor vehicle market include China, Korea, Japan and the United States, but the main sellers are China and the United States.

According to the representative of the company, vehicles from the United States has about 2-3 brands, but in recent years when TCH distributes American International vehicles, there is no competitor in the US.

TAnswering the issue in which many companies in the same industry of TCH reported significant losses recently such as TMT auto JSC (Code: TMT), while TCH maintained good business results, Do Huu Hau explained that Chinese vehicle market had a great impact on revenue, but TCH is an "exclusive distributor" American International tractor with good quality and price so the tractor segment of TCH was always maintained at a high level.

Source: Vietnambiz

Tin tức khác

- TCH dự kiến đạt doanh số 2,500 – 2,800 xe đầu kéo năm 2017

- Hoàng Huy – Làn gió mới cho phân khúc nhà giá rẻ

- Hải Phòng – Thành phố bùng nổ tiếp theo của phân khúc nhà ở giá rẻ

- TCH: Lần đầu có tên trong Bảng xếp hạng VNR500

- TCH: Khai trương Trung tâm Hỗ trợ dịch vụ sửa chữa và đào tạo xe đầu kéo International

- Lễ ký kết hợp tác giữa Hoang Huy Group và Ngân hàng TPBank

- Lễ bàn giao 200 căn hộ đầu tiên - giai đoạn 1 dự án nhà ở thu nhập thấp Pruksa Town

- HHS lần thứ hai vinh dự nhận giải thưởng “50 công ty kinh doanh hiệu quả nhất VN”

- Hoang Huy Group sẽ phân phối Đầu kéo Mỹ International tại Việt Nam

- Chương trình khuyến mãi khi mua xe Dongfeng - Hoàng Huy

201742181747.png)